Global macro signals are sending mixed but important messages. Credit conditions are easing, Canadian markets have rallied, and demographic trends continue to deteriorate. Together, these developments shape expectations for growth, policy, and risk across currencies and assets.

Banks Are Lending Again

After a prolonged period of tightening, bank lending activity is showing signs of recovery. Easing credit standards and improving loan demand suggest financial conditions are no longer restrictive at the margin.

This matters because credit availability is a leading indicator for economic momentum. When banks lend, businesses invest and households spend—supporting growth without immediate policy changes. For markets, renewed lending often stabilizes risk sentiment and supports cyclical assets.

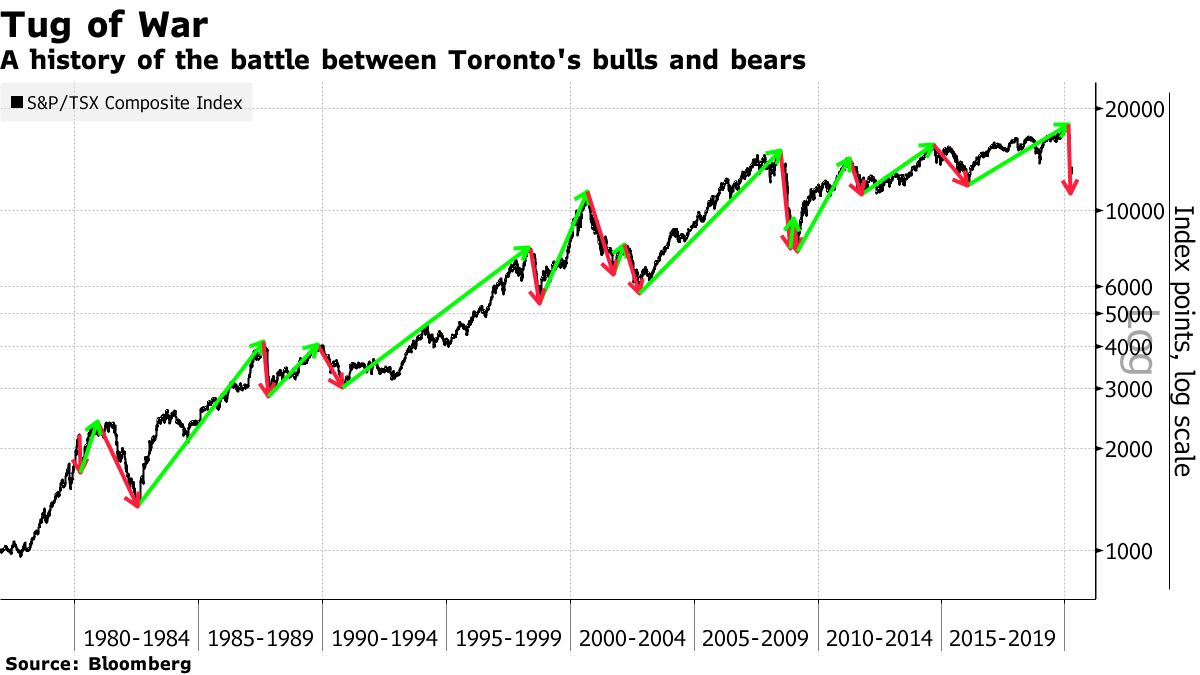

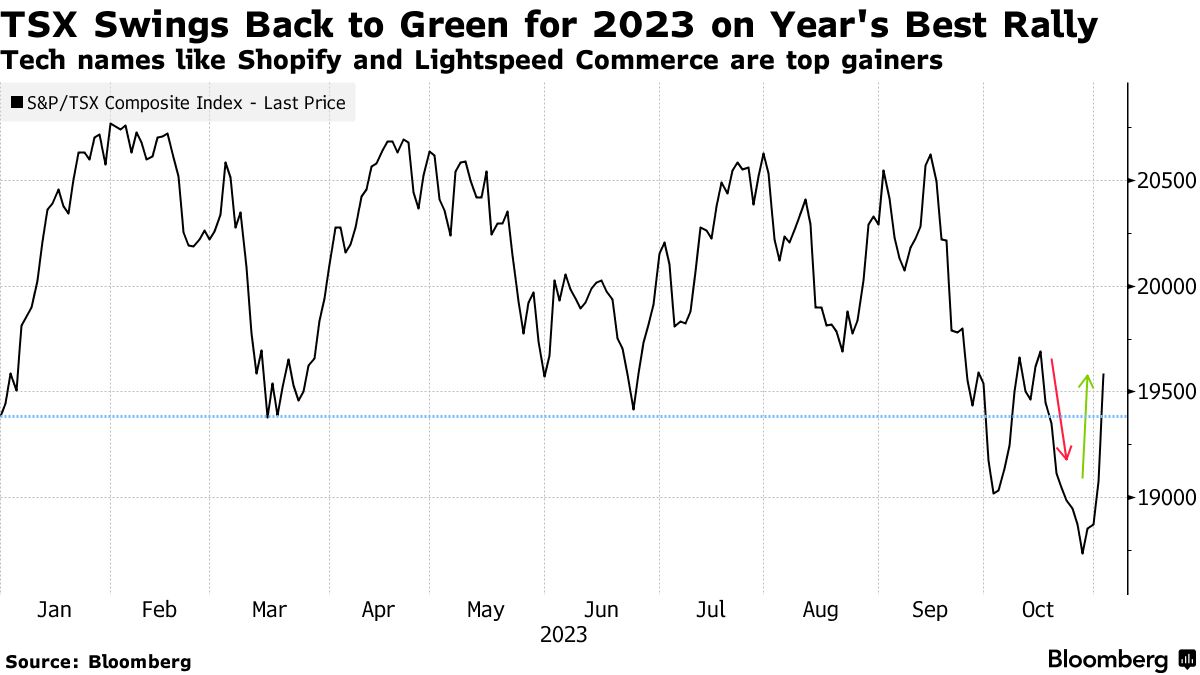

Canada’s Market Surged

Canadian equities have outperformed as investors reassessed growth prospects, earnings resilience, and policy expectations. Strength in financials, energy, and materials helped lift benchmarks, benefiting from both domestic factors and global demand.

Improving market performance also reflects expectations that the Bank of Canada can navigate a balanced path—managing inflation risks while avoiding unnecessary pressure on growth. For FX, stronger equity inflows tend to support the Canadian dollar when risk sentiment is constructive.

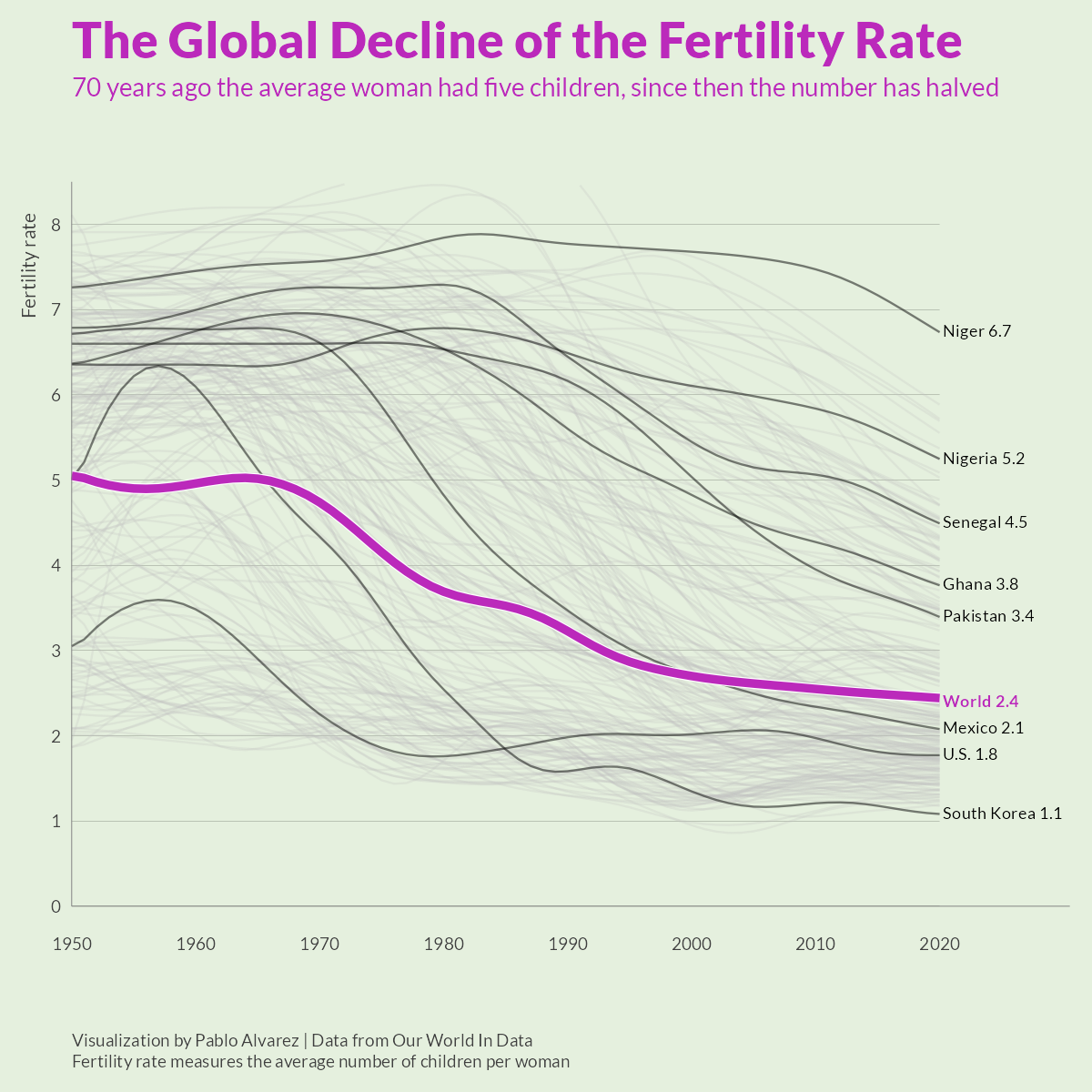

Fertility Rates Keep Sinking

While markets focus on near-term momentum, fertility rates continue to decline across many developed economies. This long-term trend carries significant implications for labor supply, productivity, and fiscal sustainability.

Lower fertility can constrain potential growth over time, increase dependency ratios, and place pressure on public finances. For policymakers, it complicates the inflation-growth tradeoff and raises the importance of productivity gains, immigration policy, and capital investment.

Why These Signals Matter Together

Taken together, these trends suggest a near-term environment that is improving—credit is flowing and markets are responding—set against longer-term structural challenges. Easing financial conditions can extend the cycle, but demographics remain a headwind that policy alone cannot quickly fix.

Market and FX Implications

- Renewed lending supports risk assets and cyclical currencies

- Stronger Canadian equities can underpin CAD during positive risk phases

- Demographic decline reinforces long-term growth constraints, influencing rates and yield curves