Starting Forex trading without a clear strategy often leads to confusion and losses. Beginners should focus on simple, proven strategies that emphasize risk control, clarity, and consistency. Below are some of the best Forex trading strategies that are easy to understand and suitable for new traders.

Trend Following Strategy

The trend-following strategy is based on the idea that prices tend to move in one direction for a period of time. Beginners identify whether the market is in an uptrend or downtrend and trade in the same direction.

Traders often use moving averages to confirm trends. Buying in an uptrend and selling in a downtrend helps beginners avoid trading against market momentum.

Why it works for beginners

This strategy is simple, reduces overtrading, and aligns trades with overall market direction.

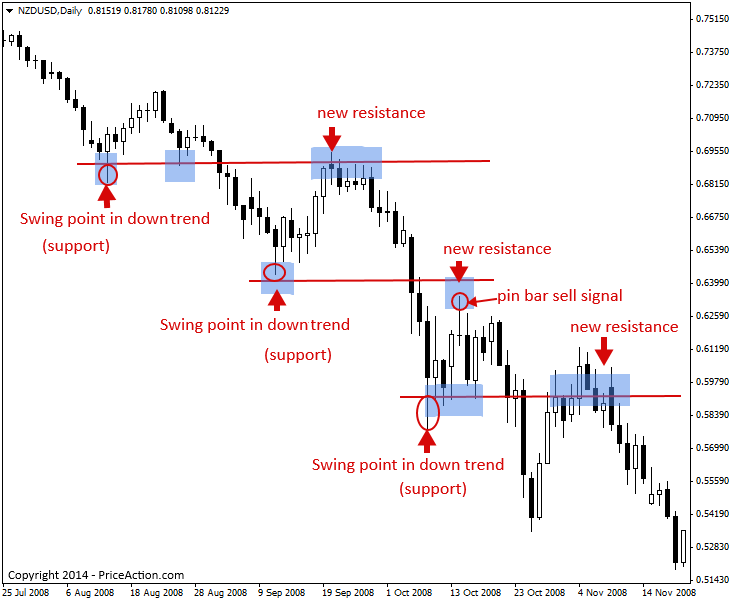

Support and Resistance Strategy

Support and resistance levels are price areas where the market has difficulty moving beyond.

Support is a price level where buying interest appears, while resistance is where selling pressure increases. Beginners can look for buying opportunities near support and selling opportunities near resistance, preferably with confirmation.

Why it works for beginners

It is visually clear, easy to spot on charts, and works well across different timeframes.

Breakout Trading Strategy

Breakout trading involves entering trades when price breaks above resistance or below support with strong momentum.

This strategy works best during high-volatility periods, such as major trading session overlaps or after key news releases.

Why it works for beginners

It captures strong price moves and avoids trading in slow, ranging markets.

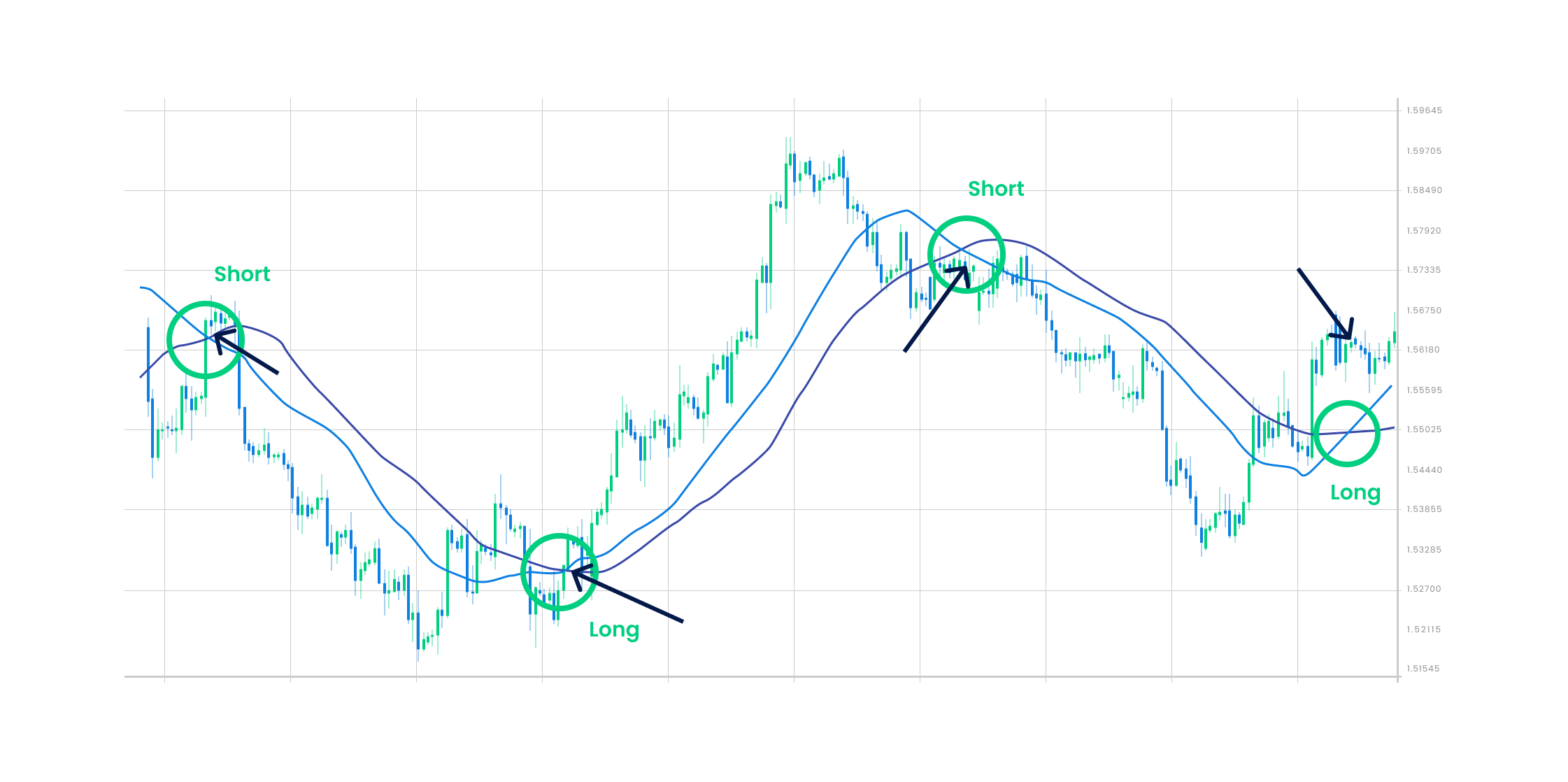

Moving Average Crossover Strategy

This strategy uses two moving averages, a fast one and a slow one. A buy signal occurs when the fast moving average crosses above the slow one, while a sell signal occurs when it crosses below.

Why it works for beginners

It provides clear signals and helps traders stay disciplined without overanalyzing the market.

Price Action Trading

Price action trading focuses purely on price movement without relying heavily on indicators. Traders analyze candlestick patterns, market structure, and key levels.

Common patterns include pin bars, engulfing candles, and inside bars.

Why it works for beginners

It improves market understanding and reduces dependence on complex indicators.

Risk Management Rules for Beginners

No strategy works without proper risk control. Beginners should always risk a small portion of their account on each trade and use stop-loss orders.

Key rules to follow

Risk only 1–2 percent of your account per trade

Always use a stop-loss

Avoid trading during high-impact news until experienced

Focus on consistency, not quick profits

Which Strategy Should Beginners Choose?

Beginners should start with trend following or support and resistance strategies. These approaches are simple, reliable, and easier to manage emotionally. As experience grows, traders can combine strategies or refine them to suit their trading style..