The Forex market is driven by economic data, central bank signals, and global risk sentiment. A daily market update helps traders understand which currencies are moving, what is driving price action, and where potential opportunities may appear during the next sessions.

Market Overview

Major currency pairs traded with mixed momentum as investors assessed economic expectations and interest rate outlooks. Liquidity increased during the London and New York sessions, leading to sharper intraday moves across USD, EUR, and GBP pairs.

US Dollar Update

The US Dollar showed selective strength as traders positioned around economic data and interest rate expectations. Movements in bond yields and expectations regarding monetary policy continued to influence demand for the dollar.

USD strength is typically supported by strong employment data, stable inflation, and a hawkish policy outlook, while weaker data can pressure the currency.

Euro Performance

The Euro reacted to regional economic indicators and market sentiment surrounding growth and inflation. Price action in EUR pairs reflected cautious trading as participants waited for clearer policy direction.

Short-term Euro movement remained sensitive to economic releases, while broader trends continued to depend on long-term economic stability.

British Pound Movement

The British Pound experienced intraday volatility driven by data expectations and policy-related developments. GBP pairs reacted quickly during active sessions, with traders focusing on inflation trends and economic resilience.

Uncertainty in economic outlook often results in sharper price swings for the pound compared to other major currencies.

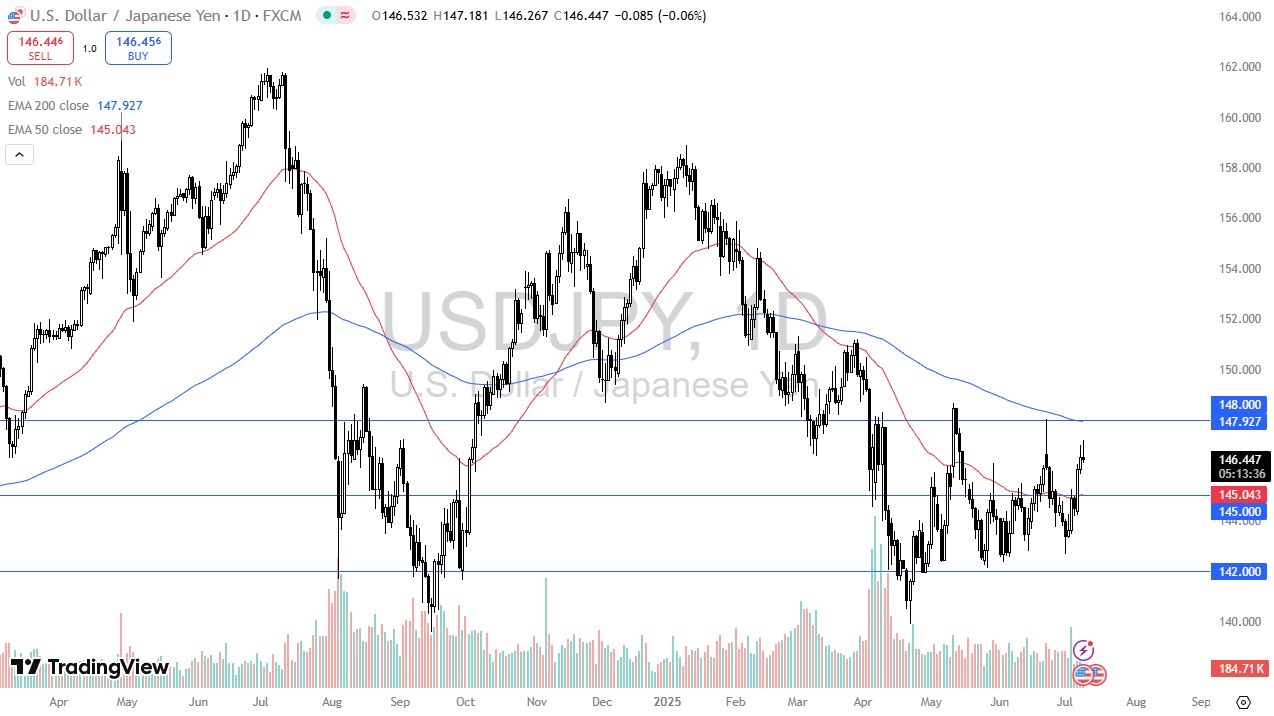

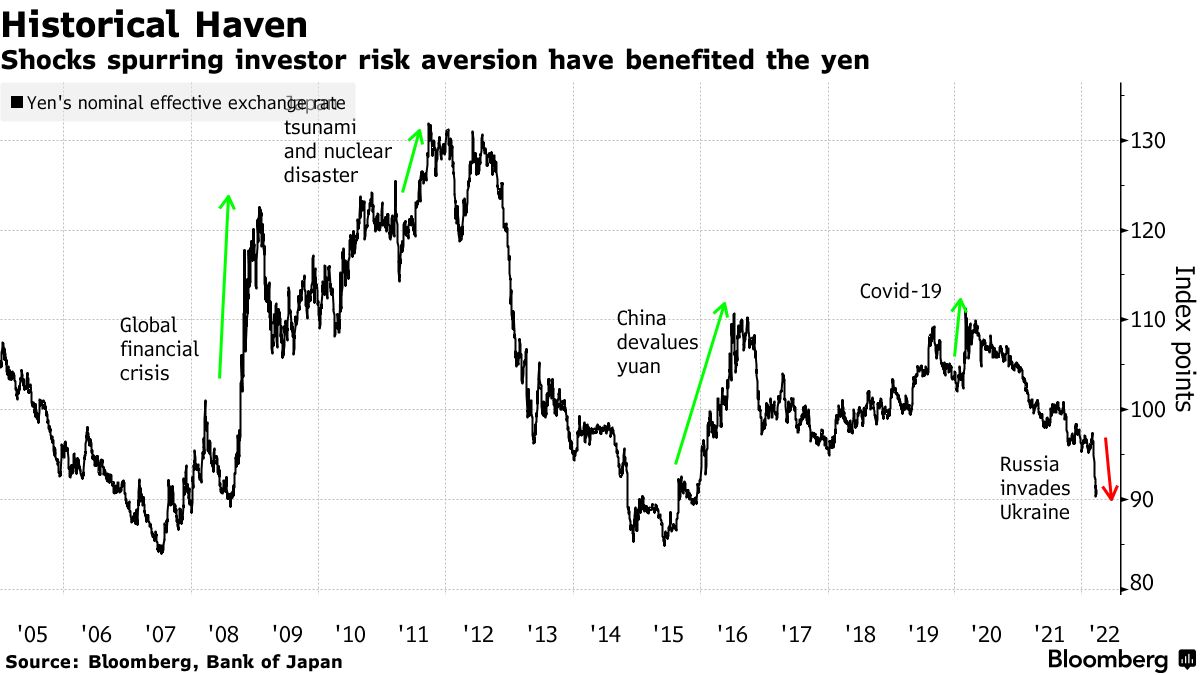

Japanese Yen and Risk Sentiment

The Japanese Yen moved in response to global risk appetite. During periods of market uncertainty, demand for the yen increased, while stronger equity markets reduced safe-haven flows.

Yen pairs remained sensitive to changes in global sentiment and yield differentials.

Commodity Currency Update

Commodity-linked currencies such as the Australian and Canadian dollars were influenced by changes in commodity prices and global growth expectations. Oil price movement continued to impact the Canadian dollar, while broader risk sentiment guided the Australian dollar.

What Traders Should Watch

Traders should monitor upcoming economic releases, central bank speeches, and geopolitical developments. High-impact events can increase volatility and quickly shift market direction.

Session overlaps often provide clearer trends due to higher liquidity, making them important periods for active traders.