Gold prices eased from intraday highs and traded around $4,328, as investors locked in profits after a strong run while reassessing interest rate expectations, bond yields, and near-term risk sentiment. The pullback reflects consolidation rather than a decisive shift in trend.

What Drove the Pullback

After reaching session highs, gold faced profit-taking amid modest moves higher in global yields and a steadier US dollar. When yields rise, the opportunity cost of holding non-yielding assets like gold increases, often prompting short-term corrections.

Market participants also pared positions ahead of upcoming macro data that could reshape expectations around growth and monetary policy.

Broader Drivers Remain Supportive

Despite the pullback, several factors continue to underpin gold prices:

- Expectations of easier monetary policy over the medium term

- Ongoing geopolitical uncertainty supporting safe-haven demand

- Central bank diversification into gold

- Persistent investor demand during periods of market volatility

These themes have helped keep gold elevated even as short-term momentum cools.

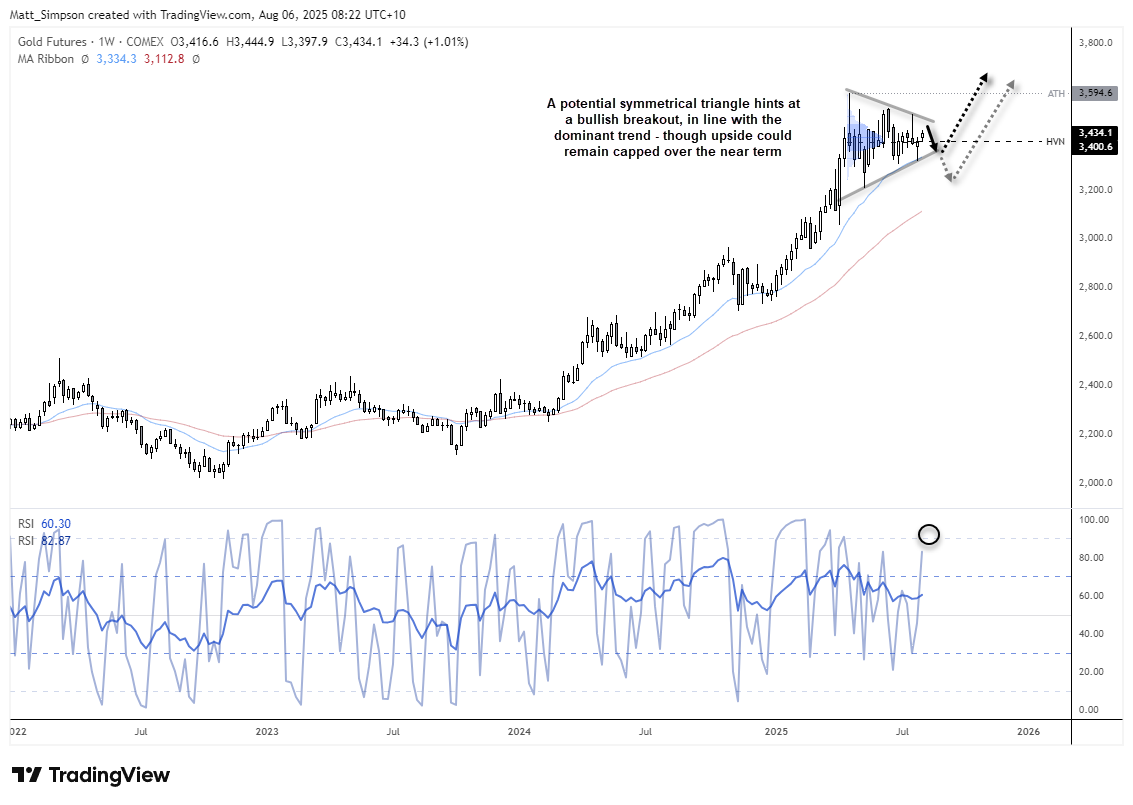

Technical Perspective

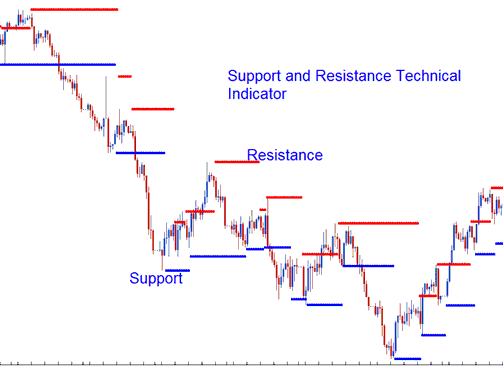

From a technical standpoint, the move lower appears to be a healthy consolidation after recent gains. Traders are watching nearby support levels to assess whether buyers step back in, while resistance remains near the recent session highs.

Sustained trading above key support zones would suggest the broader uptrend remains intact.

What to Watch Next

Key catalysts for gold include:

- Inflation and labor market data

- Movements in US Treasury yields

- Shifts in risk sentiment across equities and credit

- Central bank commentary that alters rate expectations

Any renewed decline in real yields or increase in market uncertainty could quickly revive upside momentum.