Market expectations are shifting toward a more aggressive easing cycle ahead. Many analysts believe 2026 could see up to four interest rate cuts, driven by slowing growth, cooling inflation, and tighter financial conditions. Understanding the logic behind this view—and how traders and investors can position if the Fed is “offsides” (behind the curve)—is critical for navigating Forex and broader markets.

Why Markets Are Pricing Multiple Rate Cuts in 2026

Several macro forces are converging that increase the probability of a faster-than-expected pivot.

First, economic momentum is expected to soften. Lagged effects from prior tightening typically weigh on consumption, hiring, and business investment. As growth decelerates, the policy stance can quickly become restrictive relative to the economy’s needs.

Second, inflation dynamics are easing. Disinflation across goods, moderating wage growth, and improved supply conditions reduce the need for a prolonged restrictive stance. If inflation trends toward target faster than expected, real rates rise automatically—tightening conditions even without hikes.

Third, financial conditions may tighten independently. Credit spreads, lending standards, and equity volatility can amplify slowdown risks. When markets do the tightening for the central bank, policymakers often respond with rate cuts to stabilize conditions.

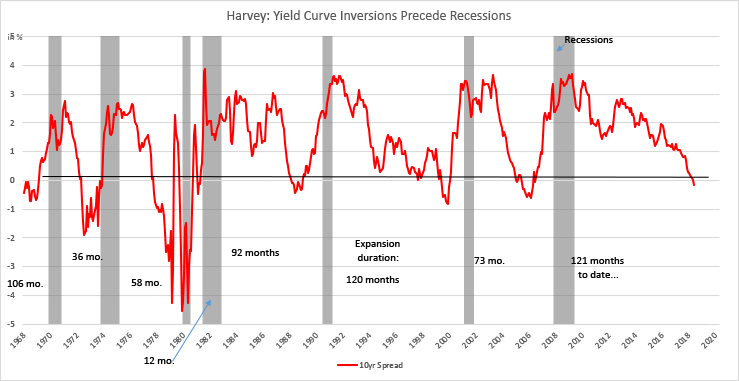

Finally, policy lags matter. Monetary policy operates with long and variable lags. If the Fed waits too long to ease, it risks overtightening—prompting a sharper corrective cycle later. Markets tend to anticipate this by pricing earlier and multiple cuts.

What “Fed Being Offsides” Means

Being offsides implies policy is misaligned with incoming data—too tight for too long as growth and inflation cool. When this happens, markets often front-run policy changes, pushing yields lower and reshaping FX trends before official action arrives.

Implications for Forex Markets

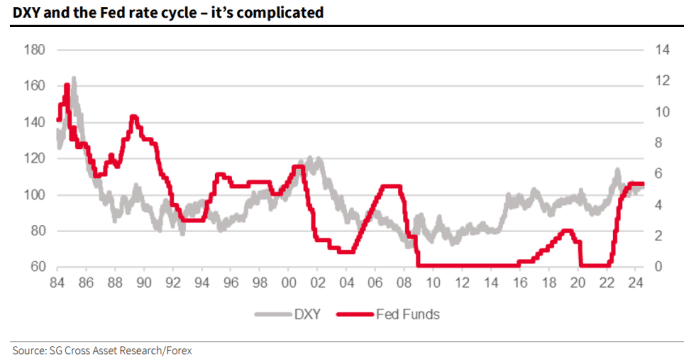

Interest rate expectations are a primary FX driver. A faster or deeper cutting cycle typically:

- Pressures the US Dollar as yield differentials narrow

- Supports higher-beta and carry currencies if risk sentiment improves

- Increases volatility around data releases and policy communication

How Traders Can Position

If the Fed is offsides, preparation matters more than prediction.

Focus on rate-sensitive pairs. Watch USD pairs where yield differentials are most influential. Shifts in expectations can drive sustained trends.

Trade data-to-policy linkages. Inflation, labor, and credit data that challenge the restrictive stance often catalyze repricing. Volatility clusters around these releases.

Use scenarios, not certainties. Plan for multiple paths: base case (gradual cuts), risk case (faster easing), and tail case (policy delay). Size positions accordingly.

Mind risk management. Policy transitions can trigger sharp reversals. Wider stops, smaller size, and patience around key events help manage drawdowns.

What Investors Should Consider

Beyond FX, falling rates typically support duration assets and risk-sensitive segments—but only if cuts are seen as preventive rather than reactive to recession. Asset selection and timing are crucial.

Bottom Line

The case for four rate cuts in 2026 rests on slowing growth, easing inflation, and the risk of overtightening. If the Fed is offsides, markets are unlikely to wait. Traders and investors who align positioning with evolving rate expectations—while managing volatility—stand to navigate the transition more effectively.